What is a UAE offshore company?

A UAE offshore company is a business registered outside the country where its primary operations take place. It’s commonly used to safeguard assets, reduce tax burdens, and maintain privacy. The offshore company benefits the owners to operate internationally while benefiting from minimal taxes, privacy, and asset protection.

These companies are popular among global investors, entrepreneurs, and even small businesses looking to expand or optimize their financial strategies. Since the UAE has no corporate or personal income tax in most free zones for Qualifying Free Zone Persons (QFZPs), offshore structures can help reduce costs while maintaining flexibility in international trade, banking, and investments.

Offshore companies in the UAE can’t do business within the country unless they establish additional mainland connections. Still, for those focused on global operations, wealth management, or holding assets, a UAE offshore company can be a smart and efficient choice. The key is understanding the legal requirements and ensuring the structure aligns with your goals.

Offshore Company Jurisdictions in the UAE

The UAE offers several well-regulated jurisdictions for setting up offshore companies, each with its advantages. The most popular options include:

RAK ICC Offshore

Key Points:

- Fast setup process

- Low incorporation costs

- Strong privacy laws

- Ideal for holding companies

- Suitable for wealth management and international trading

JAFZA Offshore

Key Points:

- Part of Dubai’s largest free zone

- Access to global markets

- Tax exemptions available

- Easy banking processes

- Suitable for international business

AFZ Offshore

Key Points:

- Cost-effective incorporation

- Quick setup process

- Ideal for SMEs

- Strong asset protection

- Investor-friendly environment

Each offshore jurisdiction offers unique benefits in terms of setup speed, cost, and business advantages. Choosing the right one depends on your business goals, target market, and operational needs.

Benefits of Setting Up an Offshore Company in the UAE

Global Market Access

An offshore company in the UAE allows businesses to operate globally without a physical presence. International Markets approach with the ability to hold multi-currency bank accounts; therefore, companies can manage cross-border transactions efficiently while minimizing foreign exchange risks.

Privacy & Asset Protection

Shareholder and director information is not publicly disclosed, offering an extra layer of security and also separating and protecting assets like intellectual property.

Tax Exemptions

No corporate tax, income tax, capital gains tax, or inheritance tax. Additionally, the UAE has double taxation treaties with over 117 countries, preventing businesses from being taxed twice on the same income.

100% Foreign Ownership

No requirement for a local UAE shareholder, eliminating the need for a local Emirati sponsor.

Fast Incorporation

Company formation can typically be completed within a week with minimal documentation.

No Minimum Capital

No prescribed minimum share capital contribution required to establish the offshore company.

Transferable Share

Shares held in offshore companies can be transferred effortlessly, offering flexibility in ownership changes.

Business Continuity

Offshore companies provide stability with perpetual existence unaffected by changes in ownership or management, ensuring long-term business continuity and succession planning.

Get in touch

A Comparative analysis - the cost of incorporation of an Offshore in Different Jurisdictions

The UAE offers several well-regulated jurisdictions for setting up offshore companies, each with its advantages. The most popular options include:

| Jurisdiction | Best For | Key Benefits | Cost (AED) |

|---|---|---|---|

| RAK ICC | Holding companies, wealth management | Fast setup, low costs, strong privacy laws | 3,000 |

| JAFZA Offshore | Global trade with Dubai access | Premium infrastructure, international recognition | 10,500 |

| Ajman Offshore | SMEs, cost-effective solutions | Quick incorporation, asset protection | 3,000 |

Cheapest Offshore Company Cost in UAE

Ajman Free Zone (AFZ) Offshore Company Formation Setting up an offshore company in the Ajman Free Zone (AFZ) offers a cost-effective and efficient solution for international business operations. One of the key requirements is obtaining the Certificate of Incorporation, which comes at an approximate cost of AED 3,000.

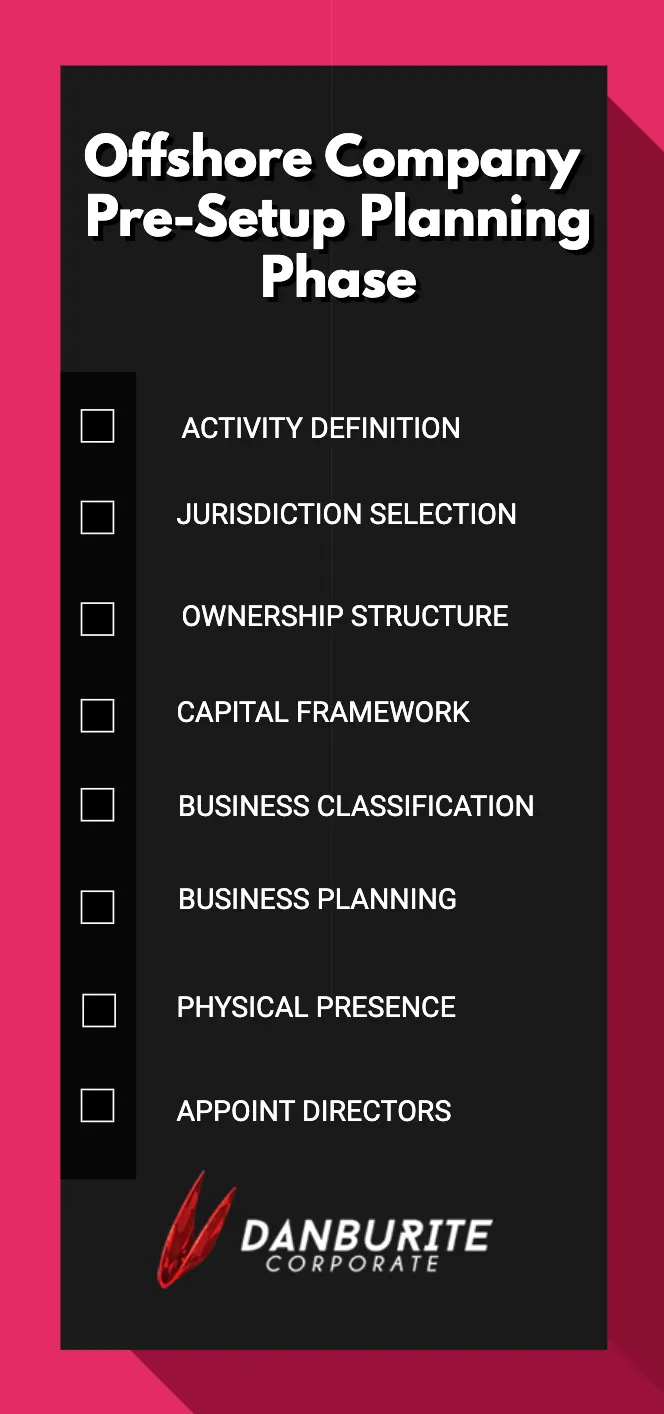

1. Activity Definition

Clearly outline permitted business activities and scope of operations.

2. Jurisdiction Selection

Choose an appropriate free zone (RAKICC, Ajman, JAFZA) based on business needs.

3. Ownership Structure

Plan shareholding pattern between individuals and corporate entities.

4. Capital Framework

Structure authorized capital, which will be reflected in Corporate Documents.

5. Business Classification

Select the proper business category from the chosen free zone's activity list.

6. Business Planning

Develop a comprehensive business plan outlining operations and projections.

7. Physical Presence

Establish jurisdictional presence through certified registered agent services such as Danburite Corporate Services.

8. Appoint Directors

Appoint minimum required directors (can include shareholders).

Setting up an Ajman Offshore company costs approximately AED 3,000 for the Certificate of Incorporation, with 0% tax, high confidentiality, and full profit repatriation.

Post-Setup Compliance & Maintenance

Annual Renewals

Maintain current license and registration status through timely renewals.

Compliance Monitoring

Establish systems for tracking regulatory changes and requirements.

Corporate Records

Maintain updated shareholder registers, director records, and corporate books.

Offshore Company Setup Options in UAE

Ajman Offshore Company Setup

Governed by Ajman Offshore Regulations, offering 0% corporate tax, high confidentiality, and full profit repatriation. Requires one shareholder and one director, with no corporate shareholding. Real estate ownership allowed in Ajman. Bookkeeping required, but auditing is usually not mandatory.

RAK ICC Company Setup

Regulated by RAK ICC Business Companies Regulations, with 0% tax and 100% profit repatriation. Allows one shareholder and one director, including corporate shareholders. Freehold property ownership permitted in RAK areas. Accounting records required, but audits are generally not needed.

JAFZA Offshore Company Setup

Under JAFZA Offshore Companies Regulations, offering no taxes and full capital repatriation. Requires one shareholder and one director, with corporate shareholders allowed. Real estate ownership permitted in Dubai’s designated areas. Annual audited accounts are typically required.

Comparison of UAE Offshore Jurisdictions

The UAE offers diverse offshore jurisdictions like Ajman, RAK ICC, and JAFZA, each with unique advantages tailored to different business needs.

Ajman Offshore

Ajman is a close alternative to RAKICC, offering similar affordability and flexibility but with less recognition than RAKICC or JAFZA. Best for, businesses focused on international trade, asset holding, or consulting without needing Dubai real estate ownership.

RAK ICC Offshore

RAKICC is the most cost-effective and flexible, ideal for startups and businesses not requiring a Dubai presence or real estate ownership. Its fast setup and minimal requirements make it attractive for businesses focused on international trading, holding companies, intellectual property management, or asset protection.

JAFZA Offshore

JAFZA (Jebel Ali Free Zone) is best suited for businesses seeking a strong Dubai presence and access to world-class logistics infrastructure, such as Jebel Ali Port and Al Maktoum International Airport. It is ideal for companies interested in owning real estate in Dubai’s designated freehold areas.

Documents Required for RAK ICC Offshore Company Setup

Passport Copies

Valid passports for all shareholders and directors. Passports must be clear, colored copies with at least 6 months validity remaining.

Proof of Address

Acceptable options include a utility bill (e.g., electricity, water, gas), Tax bill, Internet/TV or mobile bill, Tenancy or lease contract, Residency certificate, and Bank statement letter showing the full address.

Memorandum of Association (MoA)

Outlines the company's purpose and structure. The MoA must be notarized and include details of share capital, business activities, and governance framework.

Business Profile/Business Plan

A brief outline of the company's intended activities (required by certain jurisdictions). Should include market analysis, operational strategy, and financial projections for the first 3 years of business operations.

Corporate Documents (For Corporate Shareholder/Director)

Certified Copy of Certificate of Incorporation or Registration, Current Certificate of Incumbency or Register Extracts, Current Certificate of Good Standing, List of Shareholders and Ultimate Beneficial Owners.

Corporate Resolution

Approving the incorporation of the new offshore company. Must be signed by authorized signatories and include details of appointed directors, share allocation, and registered office address.

Ajman, RAK ICC, and JAFZA each offer distinct advantages, from cost savings to global logistics access. Select the jurisdiction that aligns with your business objectives and market strategy.

Offshore Company FAQs

Can't find the answer you're looking for?

Reach out to our offshore specialists

What is an offshore company in the UAE?

An offshore company in the UAE is a legal entity established in specific free zones like RAK ICC, JAFZA, or Ajman Offshore, primarily for conducting international business activities. These companies benefit from zero corporate tax, 100% foreign ownership, and high privacy and confidentiality, but they are generally not permitted to trade or have a physical presence within the UAE mainland. For expert assistance in offshore company formation and leveraging these global business advantages, Danburite Corporate is here to help, assist, and guide you.

What is an onshore or mainland company in the UAE?

An onshore company in the UAE, also known as a mainland company, is a business entity registered directly with the Department of Economic Development (DED) in one of the UAE's emirates. This setup allows you to conduct business activities throughout the entire UAE market, including direct engagement with local clients and government projects, and offers 100% foreign ownership for most business sectors. For comprehensive guidance on UAE mainland company formation and ensuring compliance, Danburite Corporate is here to help you customize every step of the process.

What is the difference between offshore and onshore companies?

Offshore companies operate internationally, often enjoying tax benefits and high privacy, without a physical presence or trading locally in their registered jurisdiction. On the other hand, onshore companies conduct business within their country of incorporation, requiring a physical presence and compliant to local regulations and taxes, with full access to the domestic market. Danburite Corporate is here to help you understand these key differences and guide you in choosing the optimal setup for your global or local business aspirations.

What are the benefits of setting up an offshore company in the UAE?

Setting up an offshore company in the UAE offers compelling advantages for global businesses and investors, including 100% foreign ownership, complete tax exemption on corporate and personal income, and strong asset protection. You also benefit from high privacy and confidentiality, streamlined company setup, and access to multi-currency bank accounts for international trade. For expert assistance in unlocking these benefits and aligning your UAE offshore company registration, Danburite Corporate is here to help, assist, and guide you.

Can an offshore company operate within the UAE market?

No, an offshore company in the UAE is generally not permitted to operate directly within the UAE mainland market or conduct business with local residents. Their primary purpose is for international trade, asset protection, and holding investments outside the UAE. They do not receive a trade license for local operations and cannot have a physical office or sponsor visas for employees in the mainland. However, an offshore company can act as a holding company by owning shares in a mainland or free zone company, indirectly accessing the UAE market through those entities. For precise guidance on UAE offshore regulations and permissible activities, Danburite Corporate is here to help, assist, and guide you.

What are the tax advantages of offshore companies in the UAE?

While the UAE introduced a federal Corporate Tax in June 2023, offshore companies can still benefit from significant tax advantages, especially if they qualify as a "Qualifying Free Zone Person." This status can lead to a 0% corporate tax rate on qualifying income, providing substantial tax efficiency for international operations. Additionally, offshore companies generally benefit from no personal income tax and no withholding taxes on dividends, interest, or royalties. For detailed guidance on maximizing these tax benefits and ensuring compliance with the latest regulations, Danburite Corporate is here to help, assist, and guide you through the complexities.

Is a physical office required for offshore company registration in the UAE?

No, a physical office is generally not required for offshore company registration in the UAE. Offshore companies are primarily set up for international business and asset holding outside the UAE mainland. They typically use the registered address of their appointed registered agent in the specific offshore jurisdiction (like RAK ICC, JAFZA, or Ajman Offshore) as their official company address. This eliminates the need for a physical office space, contributing to lower setup and operational costs. Danburite Corporate being registered agent is here to help you customize these requirements and facilitate your seamless offshore company formation.

How long does it take to set up an offshore company in the UAE?

The timeline for setting up an offshore company in the UAE can vary depending on the chosen jurisdiction (JAFZA, RAK ICC, or Ajman Offshore) and the completeness of your documents. Generally, the process can range from 2-3 business days for the fastest options like Ajman Offshore, up to 1-2 weeks for others like JAFZA, once all necessary paperwork is submitted. Danburite Corporate specializes in efficient offshore company registration and is here to help you expedite the process and ensure a smooth setup.

Can offshore companies in the UAE own property?

Yes, offshore companies in the UAE can own property, specifically in designated freehold areas, offering significant advantages like asset protection and inheritance planning. While JAFZA Offshore Companies have historically been the primary vehicle for directly owning Dubai real estate, recent agreements also allow RAK ICC offshore companies to own property in Dubai. This provides a strategic avenue for international investors to acquire real estate assets in the UAE. For expert guidance on structuring your property investments through a UAE offshore company, Danburite Corporate is here to help, assist, and guide you.

What are the compliance requirements for offshore companies in the UAE?

Offshore companies in the UAE must compliant to strict requirements including Economic Substance Regulations (ESR) if engaged in "relevant activities," mandating a genuine presence and core income-generating activities in the UAE. They also have mandatory Ultimate Beneficial Owner (UBO) declaration to enhance transparency and combat financial crime. Additionally, all offshore entities must comply with Anti-Money Laundering (AML) and Counter-Financing of Terrorism (CFT) regulations, maintain proper financial records for at least 7 years, and may need to register for corporate tax if they have UAE-sourced income or a permanent establishment. Danburite Corporate is here to help you customize these complex regulations, ensuring your offshore company remains fully compliant.

Ready to Setup Your Offshore Company?

Our experts will guide you through jurisdiction selection and ensure compliant setup.