What Is a Mainland Company in the UAE?

A mainland company in the UAE is a business entity registered under the Department of Economic Development (DED) or equivalent authority in each emirate, such as the Abu Dhabi Department of Economic Development or Sharjah Economic Development Department. Unlike free zone companies, which are confined to specific geographic zones, mainland companies can operate anywhere in the UAE and conduct business internationally without intermediaries.

Governed by the UAE Commercial Companies Law, including but not limited to Federal Decree-Law No. 32 of 2021, mainland companies benefit from recent reforms, including the removal of mandatory local sponsorship in most sectors, allowing 100% foreign ownership. This flexibility makes mainland companies ideal for businesses like trading, consultancy, manufacturing, and e-commerce that require direct access to the UAE's dynamic market.

For personalized assistance, contact our team at Danburite Corporate Services.

Benefits of Setting Up a Mainland Company in Dubai

Dubai Mainland is one of the most sought-after business destinations in the UAE

100% Foreign Ownership

With recent regulatory changes, most business activities now allow full foreign ownership, eliminating the need for a local Emirati sponsor.

No Trade Restrictions

Mainland companies can do business anywhere in the UAE and internationally, unlike Free Zone businesses which are limited to their designated zones.

Government Contracts

Mainland businesses can bid for government contracts, providing lucrative opportunities for expansion and growth.

Unlimited Visa Quota

Mainland companies can obtain multiple employment visas based on office space size, projects in hand, and business expansion needs.

No Capital Requirement

Most business activities do not have a minimum capital requirement, making it easier for entrepreneurs to start their ventures.

Business Flexibility

Mainland companies can engage in multiple business activities under a single license, allowing diversification.

Long-term Stability

Mainland companies provide a permanent business presence in Dubai, making them attractive to international investors.

Access to Talent

Companies can hire skilled professionals from across the globe without limitations imposed on Free Zone entities.

Get in touch

A Comparative Analysis of LLC Setup Costs

Setting up a Limited Liability Company (LLC) in the UAE involves a series of administrative steps, and the total cost varies by emirate.

Abu Dhabi LLC

- Trade Name Reservation AED 165

- MOA & AOA Notarization AED 600

- License & Registration AED 5,500

Key Points:

- Office cost varies by location

- License cost includes office space

- Approved off-location offices available

- E-channel mandatory from 2nd year (AED 3,250)

- AED 100 monthly penalty if not registered

Dubai LLC

- Trade Name Reservation AED 750

- Initial Approval AED 235

- MOA & AOA Notarization AED 350

- License & Registration AED 14,500

- Transaction Fee AED 115

Key Points:

- Office selection affects total cost

- Arabic names save AED 2,000/year

- Cost varies by activities and approvals

- 5% market fee on office rent

- Various office types available

Sharjah LLC

- Trade Name Reservation AED 350

- MOA & AOA Notarization AED 1,000

- License & Registration AED 9,000

Key Points:

- Physical office optional

- 13% of rent + Chamber fee included

- E-channel for visa processing

- Labor updates required for visas

- Flexible payment options available

Each emirate offers distinct advantages in terms of jurisdiction, costs, and business environment. Choosing the right one depends on your budget, target market, and long-term growth plans.

Types of Licenses for Mainland Companies

Choose the right license for your business activities

Commercial License

Covers trading activities such as import, export, retail, and wholesale. Ideal for businesses dealing in goods, from electronics to fashion.

Professional License

Designed for service-oriented businesses, including consultancy, legal services, IT solutions, and marketing agencies.

Industrial License

For manufacturing, processing, and industrial activities requiring factories or production facilities.

Tourism License

For businesses in the hospitality sector, including travel agencies, tour operators, and event organizers.

Legal Structures for Mainland Companies

The UAE offers various legal structures to accommodate different business models and ownership preferences:

Sole Establishment

A single-owner structure ideal for freelancers and small businesses. The owner bears full liability.

Civil Company

Designed for professionals (doctors, lawyers) operating as partners with shared liability.

Limited Liability Company (LLC)

The most popular structure for 2-50 shareholders, with liability limited to share capital.

Branch of Foreign Company

Allows foreign companies to establish a presence in the UAE under the parent company's name.

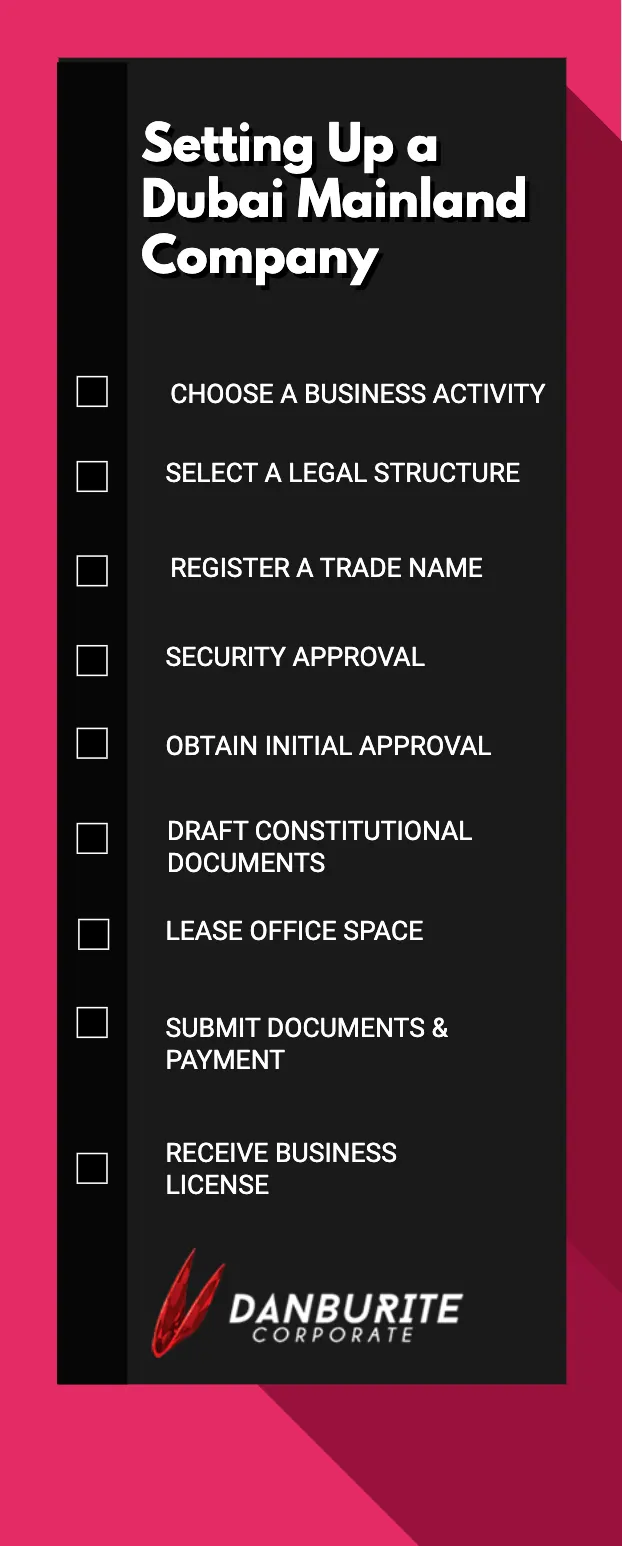

Process of Setting Up a Dubai Mainland Company

1. Choose a Business Activity

Decide whether to register as an LLC, Sole Proprietorship, Branch Office, corporate shareholder, single owner LLC, etc.

2. Select a Legal Structure

Decide whether to register as an LLC, Sole Proprietorship, or Branch Office, corporate shareholder, single owner LLC etc.

3. Register a Trade Name

Submit a unique business name to DED for approval.

4. Security Approval

Security approval for the shareholders.

5. Obtain Initial Approval

Get approval from DED to proceed with company formation.

6. Draft Constitutional Documents

Prepare MOA, AOA from notary public as per commercial regulations of Dubai.

7. Lease Office Space

Secure a business location in Dubai.

8. Submit Documents & Payment

Complete all submissions to DED and make required payments.

9. Receive Business License

DED issues the Trade License upon approval.

To know more about the process of setting up a Mainland Company in Dubai,

Post formation formalities

Open Corporate Bank Account

A corporate bank account is essential for business transactions in the UAE.

Apply for Establishment Card

Required to apply for visas under the company for shareholders & employees.

Electronic Labor Card & E-Signature

Required to apply for employee visas in the UAE.

Corporate Tax Registration

Mandatory registration is required for all companies in the UAE.

VAT Registration

Required for local trade when sales exceed 375,000 AED.

ESR & AML Compliance

Required for certain categories of companies (consult our legal advisors).

Other Regulatory Approvals

Additional approvals as per specific business requirements.

Maintain Timely Filing

Ensure all company documents and submissions are filed on time.

Documents Required for Mainland Company Formation

Passport Copies

Valid passports for all shareholders and directors (attested for certain nationalities).

UAE Visa Copies

UAE visa copies (if applicable) / copy of visit visa/entry proof in the passport.

Business Names

Preferred business names for the company (minimum 3 options).

Mainland Company FAQs

Can't find the answer you're looking for?

Reach out to our business setup specialists

What is a mainland company in Dubai?

A mainland company in Dubai is a business entity registered directly with the Department of Economy and Tourism (DET) in Dubai, operating outside of any designated free zones jurisdictions. These companies enjoy the distinct advantage of unrestricted trading across the entire UAE mainland market, including direct engagement with local customers and government entities. Most sectors now also benefit from 100% foreign ownership. For comprehensive assistance with Dubai mainland company formation and aligning local regulations, Danburite Corporate is here to help, assist, and guide you.

What is the difference between a mainland and a free zone company?

The fundamental difference between a mainland company and a Free Zone company in the UAE lies in their market access and regulatory frameworks. A mainland company (registered with the DED) can operate freely across the entire UAE market, engaging directly with local clients, and now offers 100% foreign ownership in many sectors. Conversely, a Free Zone company is restricted to operating within its specific Free Zone or for international business, benefiting from 100% foreign ownership and often 0% corporate tax on qualifying income. For expert guidance on choosing the best setup for your business expansion or local market entry, Danburite Corporate is here to help, assist, and guide you.

How much does it cost to set up a mainland company in Dubai?

The cost of establishing a mainland LLC (Limited Liability Company) in the UAE depends on the emirate where you are registering, the type of business activity, required office space, and government approvals. Below is a comparative table outlining approximate setup costs across Abu Dhabi, Dubai, and Sharjah for LLC registration:

| Particular | Abu Dhabi (AED) | Dubai (AED) | Sharjah (AED) |

|---|---|---|---|

| Trade Name Reservation | 165 | 750 | - |

| Initial Approval | - | 235 | - |

| Notarization of MOA & AOA | 600 | 350 | - |

| License & Registration | 5,500 | 14,500 | 14,500 |

| Total Estimated Cost | 6,265 | 15,950 | 10,350 |

Note: The above figures are indicative and may vary depending on your specific business activity, visa requirements, and office rental costs. Additional legal documentation or approvals may apply depending on your business sector.

What is a mainland visa in the UAE?

A mainland visa in the UAE is a residence visa issued to individuals working for or owning a company registered directly with the Department of Economic Development (DED) in any of the UAE's emirates. This visa grants you the legal right to live, work, and conduct business freely across the entire UAE mainland, with access to local markets and government contracts. It also typically allows for family sponsorship. Danburite Corporate is here to help you secure your UAE mainland visa and ensure a smooth transition.

Can a mainland company in Dubai be 100% foreign-owned?

Yes, absolutely! As of recent amendments to the UAE Commercial Companies Law, a mainland company in Dubai can now generally be 100% foreign-owned across a wide range of activities. This eliminates the previous requirement for a 51% Emirati partner in most sectors, significantly enhancing foreign direct investment and making Dubai a more attractive global business hub. However, a "negative list" of strategically important activities may still have ownership restrictions. Danburite Corporate is here to help you determine your eligibility and align the process for full foreign ownership of your Dubai mainland company.

What are the benefits of setting up a mainland company in Dubai?

Setting up a mainland company in Dubai offers unparalleled market access, allowing you to trade directly with the entire UAE market and even bid on government contracts. You benefit from high operational flexibility, the ability to open multiple branches, and recent changes allowing 100% foreign ownership in most sectors. This structure is ideal for businesses aiming for local market penetration and long-term growth within the dynamic UAE economy. Danburite Corporate is here to help you capitalize on these benefits and guide your business setup seamlessly.

Is office space mandatory for mainland company registration in Dubai?

Yes, for most mainland company registrations in Dubai, having a physical office space is a mandatory requirement by the Department of Economy and Tourism (DET). This is often evidenced by a registered Ejari tenancy contract. However, some specific business activities or modern business models, like certain consultancies or e-commerce, may be able to utilize virtual office solutions or flexi-desk arrangements to meet this requirement. For clarity on your specific needs, Danburite Corporate is here to help, assist, and guide you in securing the appropriate office solution for your Dubai mainland company setup.

How long does it take to set up a mainland company in Dubai?

The time it takes to set up a mainland company in Dubai can vary, but generally, the process ranges from 2 to 4 weeks once all necessary documents are prepared. The full process involves obtaining initial approvals, reserving a trade name, drafting legal Memorandum, securing office space, and finally, getting the trade license. Factors like the business activity's complexity and any external approvals required can influence the overall timeline. Danburite Corporate is here to help expedite your Dubai mainland company registration for a swift and efficient launch.

Ready to Setup Your Mainland Company?

Our experts will guide you through jurisdiction selection and ensure compliant setup.