Stay Compliant with UAE Corporate Tax Regulations.

The corporate tax has reshaped the compliance landscape for businesses operating in the UAE. Corporate Tax Registration in UAE is now a mandatory requirement for eligible entities, ensuring transparency, accountability, and alignment with international tax standards.

Whether you operate a mainland company, a free zone entity, or conduct business activities within the UAE, timely corporate tax registration UAE is essential. With evolving regulations and Federal Tax Authority (FTA) requirements, professional guidance ensures your UAE corporate tax registration is completed accurately and without delays.

Overview of Corporate Tax Registration UAE

The UAE corporate tax framework applies to businesses generating income from activities conducted within the country. Corporate tax registration UAE is the formal process through which taxable persons are registered with the FTA and issued a Corporate Tax Registration Number.

This registration establishes your business within the federal tax system and is required before filing corporate tax returns. Completing UAE corporate tax registration correctly safeguards businesses from penalties and strengthens their regulatory standing.

What Is Corporate Tax in the UAE?

Corporate tax in the UAE is a direct tax levied on the net profits of businesses. It applies to income earned from commercial, industrial, and professional activities, subject to the provisions of UAE tax law.

Businesses and individuals classified as taxable persons are required to register corporate tax in UAE, even if they do not immediately generate taxable income. Registration ensures readiness for reporting obligations and ongoing compliance under the UAE tax framework.

Who Needs to Register Corporate Tax in UAE?

Corporate Tax Registration in UAE applies across various business structures and ownership models. The following categories are required to register:

- Mainland companies licensed in the UAE

- Free zone companies, including those qualifying for tax benefits

- Foreign companies with UAE-based operations or income

- Individuals operating businesses under UAE commercial licences

Completing corporate tax registration UAE ensures compliance regardless of business size or revenue level.

Importance of Corporate Tax Registration in UAE

Registering for corporate tax is a legal obligation under UAE law. Failure to complete corporate tax registration UAE within prescribed timelines may result in administrative penalties and compliance risks

Choosing professional corporate tax services in UAE offers many advantages:

Corporate Tax UAE Registration Process

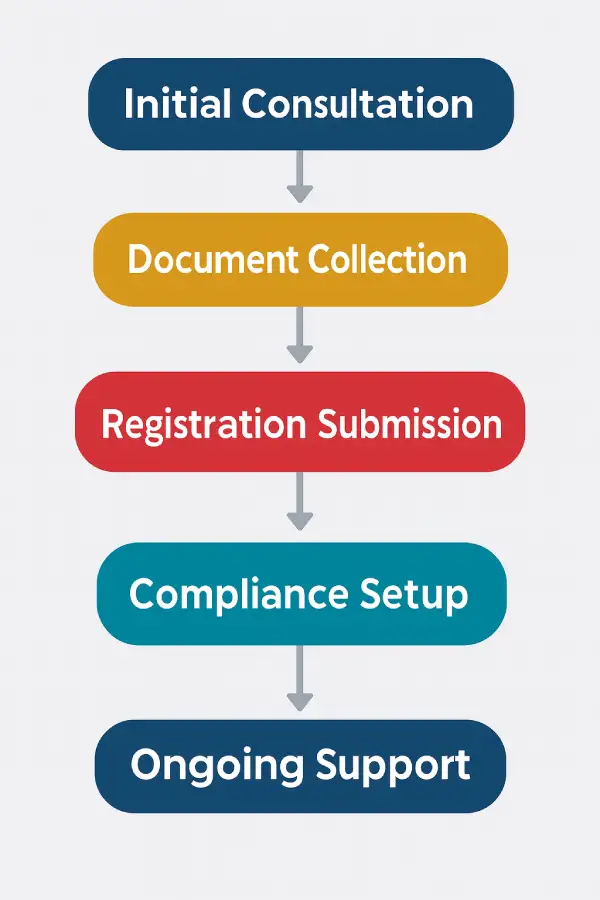

The corporate tax UAE registration process follows a structured and sequential approach. It begins with assessing whether the business qualifies as a taxable person under UAE tax regulations.

The registration process typically includes:

- Eligibility assessment under UAE corporate tax law

- Registration through the Federal Tax Authority portal

- Preparation and verification of supporting documents

- Submission of application and confirmation of registration

Professional oversight during UAE corporate tax registration helps prevent errors, portal issues, and processing delays.

Documents Required to Register Corporate Tax in UAE

To complete corporate tax registration UAE, businesses are required to submit specific documentation, including:

- Valid trade licence or business registration certificate

- Shareholder and ownership details

- Financial and accounting information

- Authorized signatory identification and contact details

Depending on the business structure and activity, additional documents may be required for UAE corporate tax registration.

Benefits of Professional Assistance

Expert guidance for seamless corporate tax registration

- Accuracy

Minimize errors in documentation and declarations.

- Efficiency

Complete registration quickly to avoid delays in tax compliance.

- Compliance Assurance

Ensure adherence to UAE corporate tax laws and deadlines from the outset.

- Ongoing Support

Consultants can provide guidance on filings, audits, and updates on changing tax regulations.

Our Corporate Tax Registration Services in UAE

Danburite provides end-to-end support for Corporate Tax Registration in UAE, managing the process from initial assessment to successful registration.

Our services include FTA account setup, application preparation, document review, and submission management. Beyond registration, we offer post-registration advisory to help businesses understand their filing obligations and ongoing compliance responsibilities.

Common Challenges in UAE Corporate Tax Registration

Many businesses encounter challenges during corporate tax registration UAE, particularly when determining taxable status or meeting registration deadlines.

Technical errors on the FTA portal, inconsistencies in documentation, and uncertainty around entity classification are common issues. With expert guidance, these risks can be addressed early, ensuring a smooth and compliant corporate tax UAE registration process.

Our proactive approach ensures that every client receives personalized solutions tailored to their specific industry and business size.

Why Choose Us for Corporate Tax Registration UAE

Danburite brings practical expertise and regulatory knowledge to Corporate Tax Registration in UAE. Our advisors stay aligned with UAE tax updates and FTA procedures, ensuring accurate and compliant registrations.

We focus on long-term compliance, not just initial registration. By choosing Danburite, businesses gain a reliable partner for corporate tax UAE registration and ongoing regulatory support.

Corporate Tax Registration Deadlines & Penalties in UAE

The Federal Tax Authority has defined specific timelines for corporate tax registration UAE, depending on the business licence issuance date and entity type. Missing registration deadlines may result in financial penalties and regulatory consequences. Completing UAE corporate tax registration on time helps businesses avoid unnecessary risks and maintain good standing with authorities.

Secure Your UAE Corporate Tax Registration with Danburite Corporate

Corporate Tax Registration in UAE is a critical compliance requirement for businesses operating in today's regulatory environment. Proper registration ensures legal alignment, financial transparency, and readiness for future reporting obligations.

With expert support, corporate tax registration UAE becomes a structured and manageable process. Danburite Corporate ensures your UAE corporate tax registration is completed accurately, efficiently, and in full compliance with UAE regulations.

We provide hands-on support, whether you're registering for corporate tax for the first time or require ongoing management of your obligations.

Frequently Asked Questions

Answers to common questions about corporate tax registration and compliance in the UAE.

Who is required to register for corporate tax in UAE?

All taxable persons, including mainland companies, free zone entities, foreign businesses with UAE presence, and individuals conducting licensed activities.

When should businesses complete corporate tax registration UAE?

Businesses must register within the timelines prescribed by the Federal Tax Authority based on their licence issuance date.

Is UAE corporate tax registration mandatory for free zone companies?

Yes, free zone companies are required to register, even if they qualify for tax incentives.

Is corporate tax registration UAE required even if there is no taxable income?

Yes, registration is mandatory regardless of whether taxable income is generated.

Ready to Register for Corporate Tax?

Our experts will guide you through the TRN registration, compliance, and filing processes.